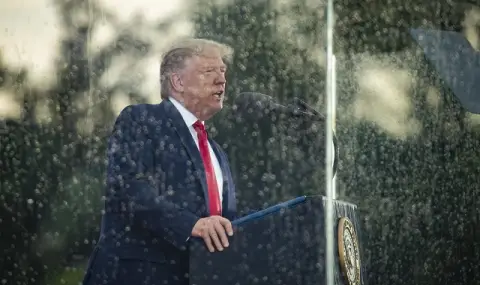

US President Donald Trump will meet with the CEOs of some of the largest US companies today, many of which have seen their market capitalizations fall in recent days as fears of recession and inflation have worsened consumer and investor sentiment, Reuters reported, quoted by BTA.

The president is expected to talk to about 100 CEOs at a regular business roundtable meeting in Washington with an influential group of CEOs leading large US companies, including technology giant "Apple", bank "JPMorgan Chase" and leading retailer "Walmart" (Walmart).

Trump's economic policy for the moment focuses on quickly announcing tariffs, some of which have already taken effect, while others have been postponed or will take effect later. The tariffs, he said, would correct imbalanced trade relations, bring jobs back to the country and stop the flow of drugs into the country, Reuters recalls.

Markets are reporting that Trump's trade policy could raise prices for businesses, stimulate inflation and undermine consumer confidence, which could affect economic growth.

Shares of US companies fell yesterday, and the S&P 500 index, which includes the 500 largest US companies by market capitalization, has fallen by nearly 3 percent since Trump was elected in November and by 4.5 percent since the beginning of the year.

Meanwhile, a survey of US households showed that consumers are becoming increasingly pessimistic about their prospects.

Trump imposed an additional 20 percent tariff on imports of Chinese goods, as well as tariffs of 25 percent on imports from Canada and Mexico, although he delayed their entry into force for most goods from the two neighbors until April 2. At that time, comprehensive reciprocal tariffs are scheduled to be announced on all U.S. trading partners.

Trump said last month that imposing tariffs could cause some short-term problems before they provide long-term benefits. In an interview with "Fox News" that aired over the weekend, he declined to predict whether his economic policies would lead to a recession.

"Business leaders have responded to President Trump's "America First" economic agenda "for tariffs and deregulation with commitments to trillions of dollars in investment that will create thousands of new jobs," said White House deputy press secretary Kush Desai, rejecting negative assessments of the economic outlook.

Until recently, investors had been hopeful that the president's policies would focus on stimulating greater economic growth, such as through lower taxes or easing inflationary pressures, such as by loosening regulations on fossil fuel production.

However, tax cuts require congressional approval, and some economists believe that plans to increase deportations of illegal immigrants are increasing the cost of labor, while cutting the federal workforce could increase unemployment.

"I think if we all become a little more nationalistic, and I'm not saying that's a bad thing, it will lead to higher inflation," said Larry Fink, CEO of the American financial corporation "BlackRock", during a business conference held yesterday.

Economists at one of the largest banks in the country, "Goldman Sachs" (Goldman Sachs Group), reduced their forecast for US economic growth for 2025 and raised their expectations for inflation, "both against the backdrop of assumptions of less favorable tariff conditions".