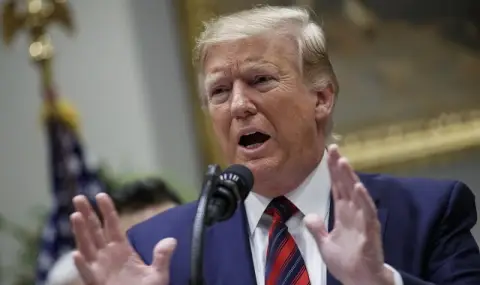

In his own mind, US President Donald Trump is a four-dimensional businessman who always outsmarts his counterparts. In a real-world trade war, however, Trump is playing the cards of his most powerful adversary and exposing some of his own limitations.

After weeks of Trump's manic tariff activity and the massive disruption of financial markets, one thing is clear: although Trump wants to overhaul the entire trading system, America, my real target is China.

By April 9, Trump had imposed new tariffs on imports from almost every country, plus additional taxes on imports of certain product categories, including cars, steel, and aluminum. No one got a reprieve.

As financial markets reeled, Trump finally stepped down on April 9, suspending most of the country-specific "reciprocal" tariffs for at least 90 days, until early July. The only notable exception is China, which has received the opposite treatment: even higher tariffs.

Trump's tariffs on Chinese imports are already at 145%, up from an average of about 6% when Trump took office and turned his sights on the world's No. 2 economy. The tariff rate is so high that it is "an effective blockade of Chinese imports", according to Heidi Krebs-Roediker, a former chief economist at the State Department and a senior fellow at the Council on Foreign Relations.

This puts China in a unique adversarial position with Trump. China has responded to Trump’s tariffs much more aggressively than most other U.S. trading partners, including many that have not retaliated at all and instead offered to make concessions. Chinese tariffs on U.S. goods are already at 84%, and China has taken other steps to hurt American businesses. China's rhetoric is also much more bellicose than anyone else's, with the Commerce Department saying in a statement that China "will fight to the bitter end."

China would avoid a trade war if it could, but it is a proud country led by a stubborn autocrat, President Xi Jinping, who is undoubtedly not keen on the trade war. Trump. And his staff also see China as a legitimate rival trying to claw its way to parity with the United States, and perhaps beyond. ΠIn recent years, Xi has preached a national belief in self-reliance and may well view the trade war with Trump as a hurdle that China must overcome on its path to economic greatness.

There are some precedents. On the one hand, Trump's tariffs tax American companies and consumers, not Chinese exporters, so the first line of damage is to U.S. stock prices. Tariffs lower stock prices because they increase the cost of doing business, reducing the prospects for future profits.

They also hurt Chinese exporters, as tariffs effectively raise the price of their products, forcing American buyers to look for other suppliers or simply buy less. But the US stock market is likely to suffer first, because stock prices are actually a predictor of future economic growth - which markets now consider a bad thing.

For Trump, this is a "good" thing, but experts are not so convinced

"&Pri;resident Trump is really losing leverage if stocks continue to "fall," said Tom Lee, co-founder of investment firm Fundstrat, in a video briefing on April 7 amid the stock market sell-off.

Πo time Trump waived the retaliatory tariffs on April 9, the S&P 500 index fell nearly 20% from its peak, putting it on the verge of a bear market. So the 20% drop in stock prices may be a measure of Trump's pain threshold.

This stock price plunge is starting to have an unintended side effect: a drop in the bond market. Bond yields — interest rates — It usually falls during a stock sell-off, as investors selling stocks usually invest money in highly liquid treasury bonds. The appreciation of government bonds raises bond prices, while at the same time lowering the interest rates at which investors are willing to hold them.

But from April 4 to April 9, U.S. Treasury yields rose by more than four-tenths of a percentage point, when they would normally fall. At the same time, the dollar has fallen by an unusually large amount against the euro and other currencies, suggesting that a chaotic sell-off of US assets with potentially dire consequences could be underway.

This has increased pressure on Donald Trump.

"The rise in 10- and 30-year Treasury yields appeared to be the tipping point "to pressure Trump to suspend these tariffs for 90 days," Krebo-Rediker said, quoted by the financial publication Yahoo! Finance.

Investors are suddenly wondering whether China or a group of U.S. trade adversaries could trigger a U.S. financial crisis by deliberately selling Treasury bonds to raise U.S. interest rates, which could freeze credit markets.

A credit crunch is usually worse than a stock sell-off because if it can Liquidity impact, companies need to pay their bills, especially if it happens quickly. The credit crunch and frozen liquidity helped turn the housing bubble of 2008 into a financial bubble, which almost turned into a depression.

China owns about $760 billion in U.S. Treasury securities, or 2.6% of total U.S. debt traded on public markets. The share has declined in recent years and is likely not enough for China to use the weapon as leverage to confront Trump in a trade war. China would suffer from any credit crunch that hit the United States, which could hinder the ability of many nations to buy Chinese goods at current levels.

But the sheer size of the U.S. debt burden—which will only increase as Trump pushes for deficit-financed tax cuts—is a vulnerability, which Trump may not have counted on when he started his trade war.

The higher his tariffs, the more damage they will inflict on the U.S. economy and the more likely foreign investors are to withdraw, putting upward pressure on interest rates. China sees this, and Trump is now showing his sensitivity to the possibility of a credit crunch.

As an author who no longer has to worry about elections, he can endure political pain longer than Trump. But China also has its vulnerabilities. Trump's tariffs will harm many Chinese companies and the entire Chinese economy if they remain in force for a long time. He is powerful but not always decisive, and there is no obvious way to outsmart Trump.

"He can escalate and cause more pain, or he can hold back and look weak both to foreign adversaries and to the domestic public," wrote Craig Singleton of the Foundation for the Defense of Democracies in Foreign Relations.

"Either otherwise, the pressure is on."

Donald Trump says he is ready to negotiate with trading partners, but he has also expressed interest in "separating" the US and Chinese economies after 25 years of deep integration. This process may have begun, and while Trump has the will, it may be irreversible.

By narrowing the focus of his trade war on China, the American president may mobilize consumers he cannot afford to waste elsewhere. China may not be able to win a trade war outright, but it can certainly be a prickly enemy that causes a lot of damage - and it knows where to aim.